Investing can be a rollercoaster ride, full of ups and downs. The key to success in this arena is finding an asset management philosophy that aligns with your goals. As the saying goes, “different strokes for different folks,” and this certainly applies to investment strategies. Each person has unique financial objectives and risk tolerances, which means there is no one-size-fits-all approach to investing.

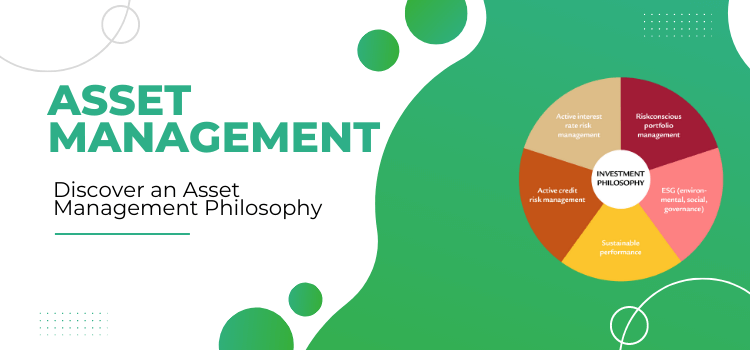

To navigate the complex world of asset management, it’s important to understand the various philosophies that exist. From value investing to growth investing, from active management to passive indexing, each approach has its own strengths and weaknesses. By familiarizing yourself with these concepts, you can begin to identify which strategies may be best suited for your goals. In this article, we will explore some of the most popular asset management philosophies and provide guidance on how to choose the one that aligns with your investment objectives.

Understanding Different Asset Management Philosophies

Various asset management philosophies exist, each with unique principles and strategies that guide investment decision-making processes. The two most prevalent approaches in the market are passive vs active management, and value vs growth investing. Passive management is a popular strategy that involves building a portfolio of assets to mirror a specific index or benchmark. The idea behind this approach is to achieve returns similar to those of the chosen benchmark, while minimizing costs and reducing risks associated with active trading.

On the other hand, active management involves making investment decisions based on research and analysis of financial markets. This philosophy aims to outperform benchmarks through careful selection of securities. While active managers may have higher fees than passive ones, they offer investors more flexibility in terms of investment choices and can adapt quickly to changes in market conditions.

Value vs growth investing is another critical distinction within asset management philosophies. Value investors seek undervalued stocks that are trading below their intrinsic value, whereas growth investors look for companies with high potential for earnings growth but may be overvalued by traditional metrics. Both strategies have their merits and drawbacks, depending on an investor’s goals and risk tolerance level. Ultimately, selecting an asset management philosophy requires understanding these different approaches’ intricacies and determining which aligns best with one’s investment objectives.

Identifying Your Investment Goals

Defining the desired outcome is an essential first step when developing a long-term investment strategy. Identifying your investment goals involves assessing your financial situation, risk tolerance, and time horizon. Long term vs short term goals are two primary categories of investment objectives that individuals can have.

Long term goals typically involve planning for retirement, saving for future higher education expenses or purchasing a house, while short term goals include building an emergency fund or saving up for a vacation. Balancing risk and return is another critical aspect of identifying your investment goals. Risk refers to the amount of uncertainty or potential loss associated with investing in a particular asset class. Return relates to the gains investors earn from their investments over time. Identifying your risk tolerance helps you determine how much volatility you can withstand in your portfolio without losing sleep at night. In contrast, determining your desired rate of return allows you to develop realistic expectations about what returns you should expect from different types of investments over the long run.

Evaluating Asset Management Options

Assessing the suitability of different investment vehicles and determining their associated costs is a crucial step in evaluating available asset management options. One important aspect to consider during this process is risk assessment. Risk tolerance varies among individuals, and understanding one’s own level of comfort with risk can help guide investment decisions. For example, some may prefer lower-risk investments such as bonds or stable dividend-paying stocks, while others may be willing to take on higher levels of risk for potentially greater returns through investments in growth-oriented companies or emerging markets.

Another key factor to evaluate when considering asset management options is portfolio diversification. Diversifying one’s investments across various sectors, industries, and geographical regions helps spread out risk and minimize potential losses due to any single investment’s poor performance. Different types of assets also have varying degrees of correlation with each other – that is, they may react differently to market fluctuations – so incorporating a mix of assets within a portfolio can lead to more stable overall returns over time. Ultimately, understanding one’s own goals and preferences for balancing risk versus reward, as well as exploring various options for diversification across asset classes and geographies, can aid in finding an appropriate asset management philosophy that aligns with individual financial objectives.

Choosing the Best Philosophy for You

Understanding one’s personal risk tolerance and exploring different investment strategies for portfolio diversification are crucial factors to consider when choosing the most appropriate asset management philosophy. Investment strategies vary depending on the level of risk tolerance an individual has, as well as their investment goals and preferences. Some popular options include passive investing, active investing, value investing, growth investing, and income investing.

Passive investing involves buying a diversified mix of low-cost index funds or exchange-traded funds (ETFs) that track a market index such as the S&P 500. Active investors aim to outperform the market by conducting research and analysis to select individual stocks or actively managed mutual funds. Value investors focus on finding undervalued stocks with strong fundamentals, while growth investors seek companies with high potential for future growth. Income investors prioritize investments that generate regular income in the form of dividends or interest payments. Ultimately, selecting the best asset management philosophy depends on one’s unique financial situation, goals, and preferences for balancing risk and return.

Frequently Asked Questions

The minimum investment amount required to start an asset management portfolio depends on the specific firm and investment strategy chosen. Some firms may offer flexibility in investment amounts, while alternative funding options such as loans or crowdfunding may also be available.

The realization of significant returns in an asset management strategy can depend on a long term approach and individual risk tolerance. Euphemistically speaking, it may take time for such returns to materialize. Personal goals should align with the chosen philosophy.

Comparing fees for asset management services can vary widely depending on the level of service and expertise provided. Negotiating rates may be possible, but it’s important to consider the impact on overall returns before making a decision.

Sustainable investing has gained popularity, and ethical exclusions are a common strategy used to align investment portfolios with personal values. Customizing asset management portfolios to exclude specific industries or sectors can be achieved by discussing this preference with the chosen asset manager.

Rebalancing frequency is an important consideration for asset management strategy. Factors such as investment horizon and risk tolerance should be taken into account when determining the appropriate frequency of portfolio rebalancing to align with one’s goals.

Conclusion

Asset management is a crucial aspect of financial planning, but it can be overwhelming to choose the best philosophy that aligns with your investment goals. Understanding different asset management philosophies and identifying your objectives are essential steps in evaluating your options. Some popular approaches include passive investing, active investing, and socially responsible investing (SRI). While passive strategies focus on low-cost index funds that track market performance, active investments aim to beat the market through expert analysis and stock picking. SRI aims to invest in companies that align with ethical or environmental values.

To evaluate which philosophy suits you best, consider factors such as risk tolerance, time horizon, and financial objectives. A study conducted by Vanguard found that investors who used a passive approach outperformed those who used an active approach over a ten-year period. However, this does not mean that one strategy is superior to another as each investor’s situation may vary.

In conclusion, determining an asset management philosophy that aligns with your goals requires careful consideration of various factors. It’s vital to understand different approaches such as passive investing, active investing, and SRI before deciding on the best option for you. While there is no one-size-fits-all solution for every investor’s needs, having a clear understanding of your investment objectives can help make informed decisions about how to manage your assets effectively. As per Vanguard’s study mentioned earlier, it’s interesting to note that 85% of actively managed funds underperformed their respective benchmarks over the past decade; hence choosing the right investment philosophy could significantly impact achieving long-term financial goals.

Leave a Reply